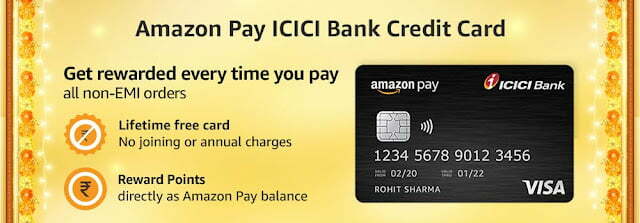

Amazon Pay ICICI Bank Credit Card

What is Amazon Pay ICICI Bank Credit Card?

Benefits Of Amazon Pay ICICI Bank Credit Card:

- Earn Unlimited 5% Reward Points on Amazon.in purchases for Amazon Prime Members

- Earn Unlimited 2% Reward Points on Recharge, Bill Payment, Loading Pay Balance etc

- Earn 3% Reward Points on Amazon.in purchases for Amazon None Prime Members

- Earn 2% Reward Points on 100+ Amazon Pay partner merchants

- No joining fees or annual fees

- No limits on earnings for this credit card.

- No expiry date to your earnings

How To Apply For Amazon Pay ICICI Bank Credit Card-

FAQ-

4. What are the different modes of completing Amazon Pay ICICI Bank Credit Card KYC verification?

Amazon Pay ICICI Bank Credit Card offers two modes of completing KYC verification.

a. Video KYC: You are required to provide PAN card and Aadhaar details followed by video-based verification with ICICI Bank officer. You will be required to come on camera by accepting the call request by the ICICI Bank officer and complete your video KYC call by answering few questions asked by the office and showing the original PAN card copy.

b. In person verification: You will need to schedule KYC appointment for the in-person KYC verification process. We are currently live in 63 cities. You can check the list of pincodes serviceable by clicking here. A KYC agent will visit you to complete your application form and below documents are accepted.

i. Any one of the government issued address proof- Aadhaar/Driving license/Passport/Voter card

ii. PAN card (only if your full DOB is not mentioned on Aadhaar card).

iii. Income Documents

- Latest Salary Slip, 3 month bank statements (for salaried)

- Latest ITR with income computation statement (for self-employed)

iv. For any questions on documents required, you can refer to the e-mail sent to your registered e-mail address by ICICI Bank

5. How can I complete video-based KYC verification for Amazon Pay ICICI Bank Credit Card?

You can complete video-based KYC verification by following below steps:

- If you have not filled the online application, click on “Apply Now” or “Complete your application” to fill the online application first

a. Complete Aadhaar OTP verification: In the online application of this credit card, you need to fill Aadhaar number and PAN number, and verify OTP send on your Aadhaar linked mobile number.

b. Provide Address Details: Provide your current residence address if it not same as Aadhaar address and office address - If you have already filled online application, click on “Check Application Status” and complete your KYC by choosing video KYC option

a. Video live chat with ICICI Bank officer: Following experiences are possible in this process:

• Auto dial-in: You will be auto redirected to live video conference with ICICI Bank officer who will ask you to provide answer to one of these questions – DOB, Fathers name, address to complete digital verification. In case ICICI Bank officer is not available at that moment, we will ask you to wait for few minutes. In case you decide to do it later, you can come back to Amazon Pay ICICI Bank Credit Card page and click on “Check Application Status” to initiate video KYC process. Video KYC is available from 10am to 6pm from Monday to Saturday.

6. Do I need in-person verification post completing video KYC?

No, In-person verification is not required post completing video KYC process successfully.

7. Can I complete video KYC if I don’t have Aadhaar card or PAN card?

No, as per RBI guidelines PAN card and Aadhaar details are required for completing verification remotely. In case PAN card is not available then you will not be able to complete KYC verification for Amazon Pay ICICI Bank Credit Card. However, in case you do not have Aadhaar card, you can opt for in-person verification by providing any other address proof like Passport/Voter card/Driving license.

8. Do I need smart phone to complete video KYC? Do I need to download any app to complete video KYC?

Yes, smart phone is required to upload income documents and conduct video-based verification for Amazon Pay ICICI Bank Credit Card. You are not required to download any app to complete video KYC. Video KYC verification will be initiated from your Amazon Pay ICICI Bank Credit Card application hosted at ICICI Bank. In case you could not complete the video KYC process, you can come back to Amazon Pay ICICI Bank Credit Card page on Amazon and re-initiate the KYC process.

9. My internet connectivity is poor and I am not able to complete my video KYC, what should I do?

You can try video KYC from your office or at different location where connectivity is better. You will not need to reupload the income documents already uploaded. In case you are still not able to complete video KYC, you can schedule appointment for in-person KYC verification.

10. Do I need to be present at my permanent address for completing video KYC?

No, you can complete video based KYC verification from any location in India. As per RBI guidelines, you need to be in India while completing video KYC.

11. How much time does it take to complete video KYC?

It takes less than 5 mins to complete video KYC verification. ICICI Bank officer will verify your details while talking with you on video call.

![[Top 13] Best Ludo Earning Apps To Win Money In 2024](https://www.dealbricks.com/wp-content/uploads/2021/10/Ludo-Earning-Apps-2-100x70.webp)